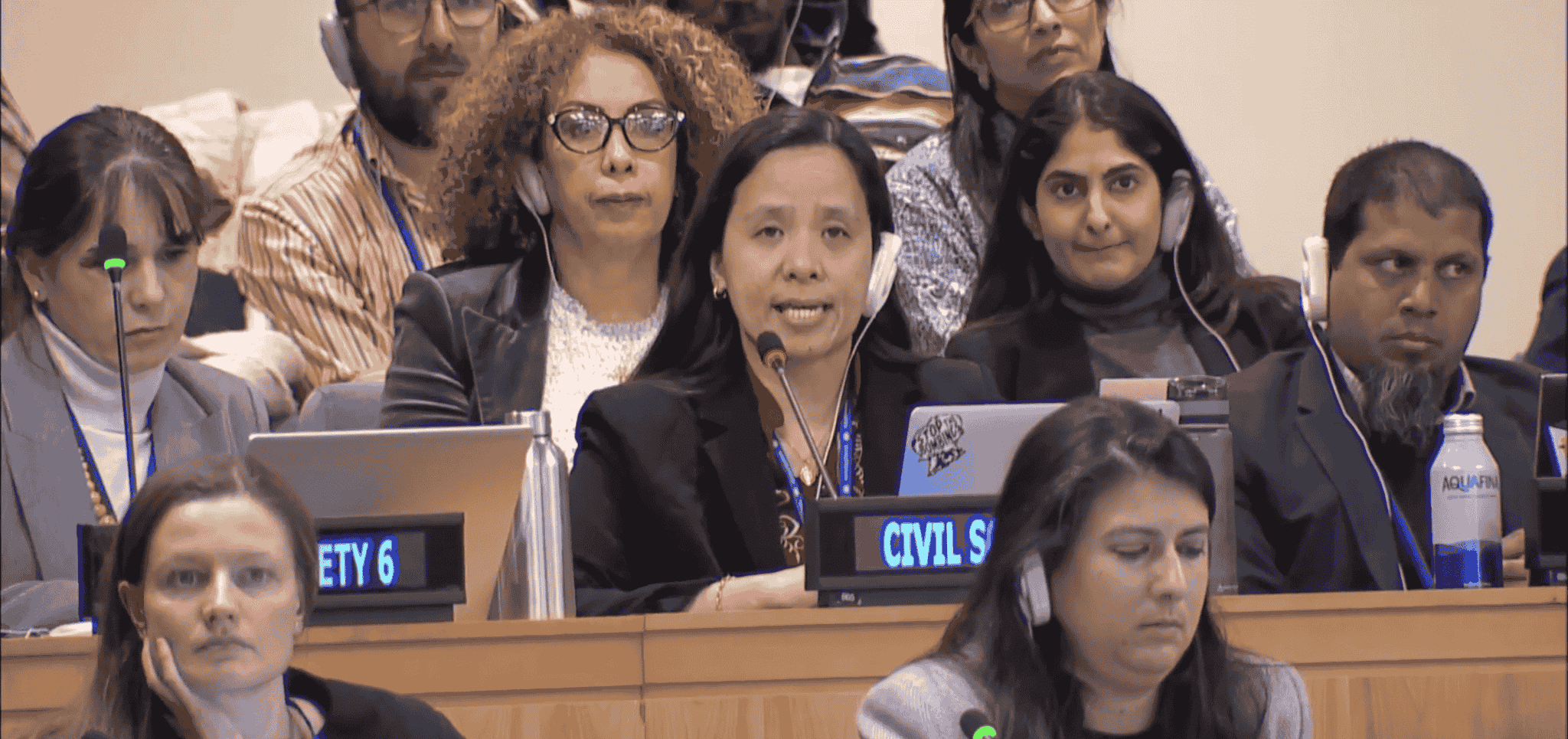

Jennifer del Rosario-Malonzo, Executive Director of IBON International, spoke on behalf of the Civil Society Financing for Development (CS FfD) Mechanism at the official panel discussion on the International Development Cooperation, at the 2024 UN Financing for Development Forum held on 22-25 April 2024 at New York City. She asserted the need for a convention on development cooperation that treats unfulfilled commitments as “aid debt,” and the need to have a UN-led intergovernmental process on multilateral development banks.

We heard much about using public finance to catalyse private flows, with instruments like blended finance, guarantees and others. Being a catalyst, aid is diluted to count other purposes, such as in-donor costs, aid for trade and other vested interests, with donor countries even reneging on ODA programmes. Military spending has been increasing at the expense of development needs. Systematically, “aid,” an obligation for public interest objectives of addressing poverty and inequalities after decades of colonialism, is being dismantled.

Structural trends remain the same: for decades, the international financial architecture is failing to deliver, and is an architecture of net outflows and extraction from the global South. From the 1960s to the late 2010s, the global North has extracted USD 152 trillion worth of resources from the global South. The same calculations by academics show that for every USD 1 of aid, USD 14 flow out in wealth drains. This increases to USD 30 if we include profits sent back to Northern countries and illicit flows. Meanwhile, donors are moving away from meeting the 0.7% commitment, thus unmet ODA debt owed to the Global South is estimated to be around USD 6 trillion.

When powerful actors, like the World Bank, orchestrated the chorus of a “financing gap” to be filled by private finance leveraged by public funds, they refuse to account for the systemic roots of unequal economic relations: that countries’ power over their own resources and development paths have been taken away. We need to unpack this hype over multilateral development bank (MDB) reform if the World Bank Evolution is just repeating the faith in private finance, despite the failure of transforming “billions into trillions.” With the World Bank’s questionable track record in climate action in the global South, we are concerned that the Bank will manage the Loss and Damage funds in the same vein.

We are asked: “how should international development cooperation look like amid multiple crises?” We all agree that it is time to redesign the international financial architecture. For civil society, this reform needs to address the extractive structures and dynamics that have barred structural transformation of economies in the global South.

To advance effective development cooperation fit for the needs of our time: we need an architecture that is (1) accountable; (2) advances democratic governance; and (3) fit for the purpose of correcting historical and continuing economic drains.

First, we need to move the governance centre of development cooperation away from the donor clubs – like the OECD-DAC – towards a more even terrain to ensure that development cooperation is aligned with the interests, priorities and needs of developing countries. We thus call on states to advance a convention on development cooperation, under UN auspices, that could hold Northern states accountable for their unfulfilled historical commitments on quantity and quality, and recognise the trillions of unmet aid commitment as aid debt.

Second, we need MDBs to shift decision-making and democratise governance. We from the global South do not need an evolution that retains the political economy tied to Northern states and financial investors. Instead of Finance in Common or multiple MDB processes without clear member-state mandate, we call for a UN intergovernmental process on MDBs. A democratic space to discuss MDB governance reforms and accountability, such as that of the World Bank, is crucial towards transforming economic models driven by extraction and outflows from the global South. The same process must lead to a much-needed review of private finance-first approaches promoted by MDBs.

It is time for international development cooperation to be about reparations and supporting structural transformation – which means upholding peoples’ sovereignty over Southern industrial policy and development paths. We look forward to engaging with UN Member States to advance these issues for the upcoming 4th UN Conference on Financing for Development. #