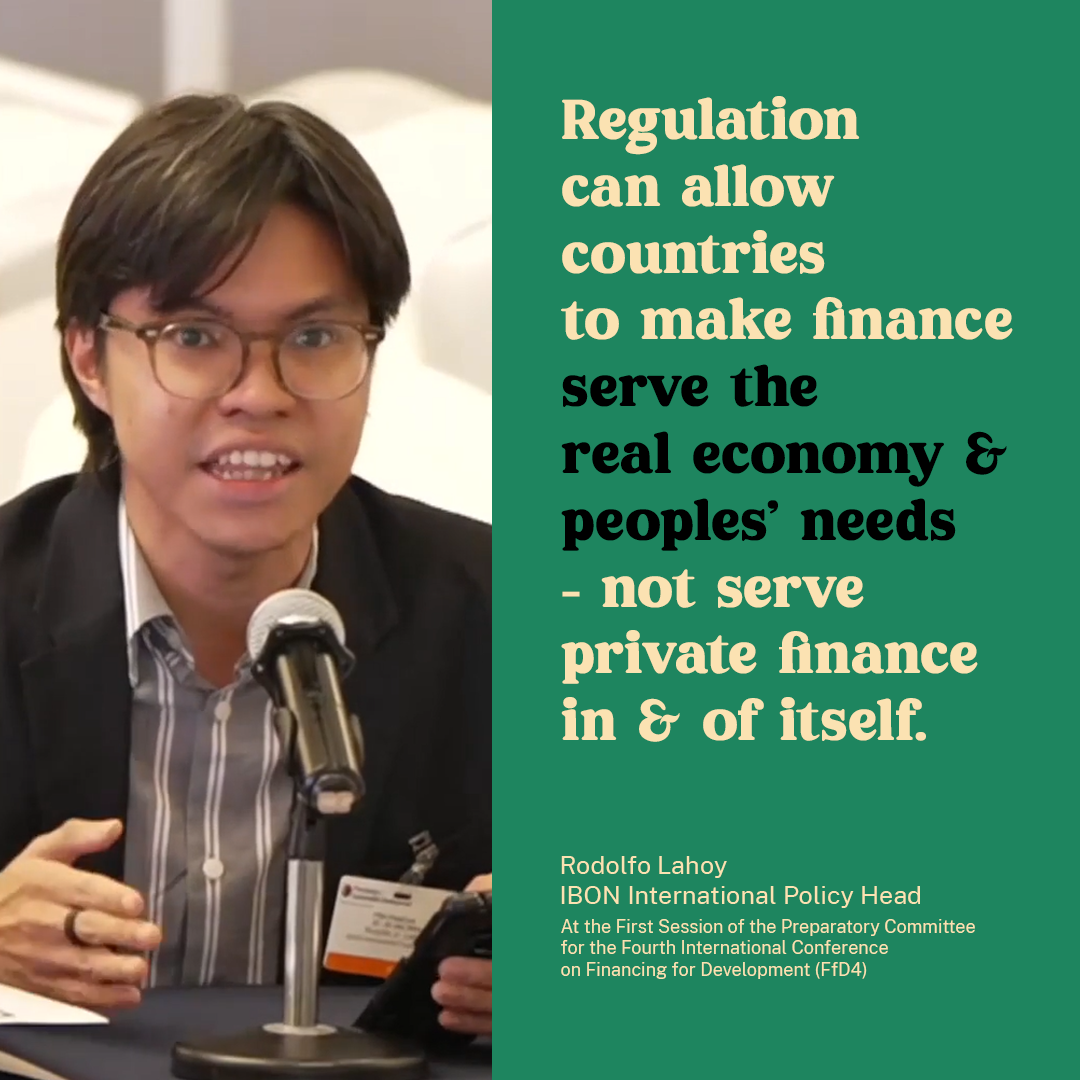

On behalf of Civil Society Financing for Development Mechanism, Policy Head Rodolfo Lahoy delivered an intervention to the Domestic and International Private Business and Finance session at the Third Preparatory Committee Session for the Fourth International Conference on Financing for Development (FfD4) held on 12 February 2025:

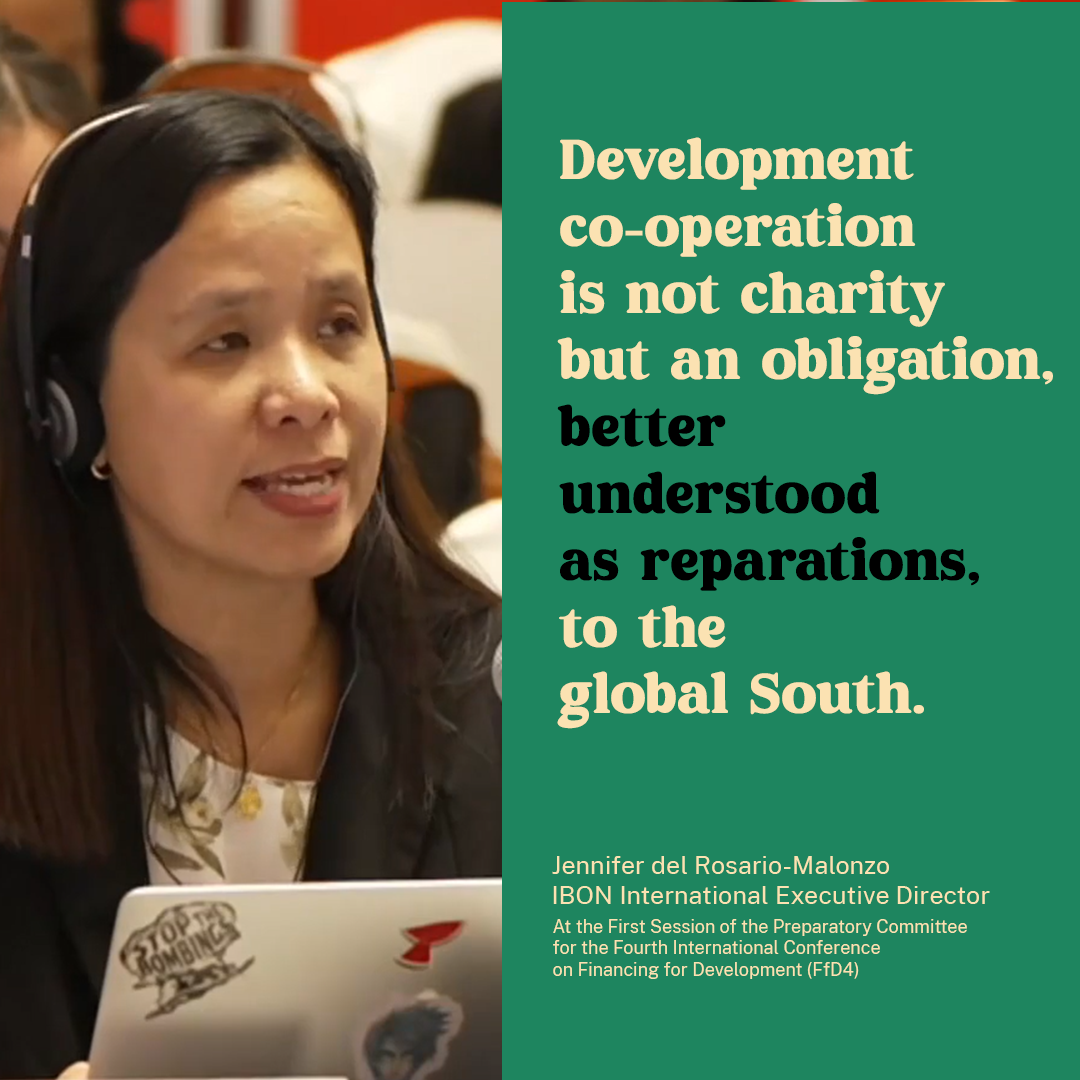

FfD4 could reinforce the role of the UN in economic governance by establishing normative and actionable proposals to rethink the prevalent private finance-first approach. It is key to strengthen the FfD4 process and uphold transparency and inclusiveness for CSOs amid restrictions foreseen in the negotiation roadmap. We look forward to clarity on CSO participation and access to the negotiations throughout the process, towards our full engagement.

We note an appetite to standardise blended finance, from the ministerial segment and paragraph 35. Our actions on blended finance should be based on a clear view of whether it is a reliable tool. Issues of unclear development outcomes and lack of financial additionality require transparent and inclusive discussion.

We propose to replace the first sentence of paragraph 35.d with “We will establish a UN intergovernmental process to review the sustainable development outcomes, fiscal, labour and human rights impacts of blended finance and other financing instruments to leverage private finance, as well as public-private partnerships”; and delete paragraph 35.f. The review should provide the basis to identify the appropriate policy toolkit to regulate private finance in the public interest.

Regulation requires Southern policy space to decide which private actors are apt for our contexts, strategies, and industrial and agricultural transformation. There is no “one size fits all,” as noted by Cuba. We propose the line “We support the advancement of sustainable industrial policy in developing countries, as a basis for notions of impact,” to replace the first two sentences of paragraph 36.a. We also propose revising 35.a. with “aligning appropriate and demand-driven foreign direct investment with national development priorities.” We recommend the deletion of paragraphs 34.e and 35.g, h, i; we are concerned with the expansion of MDB roles in catalysing capital and projects, amid outstanding issues of harms, trends of resource extraction, and diversion of scarce public resources in de-risking approaches promoted by major MDBs. #