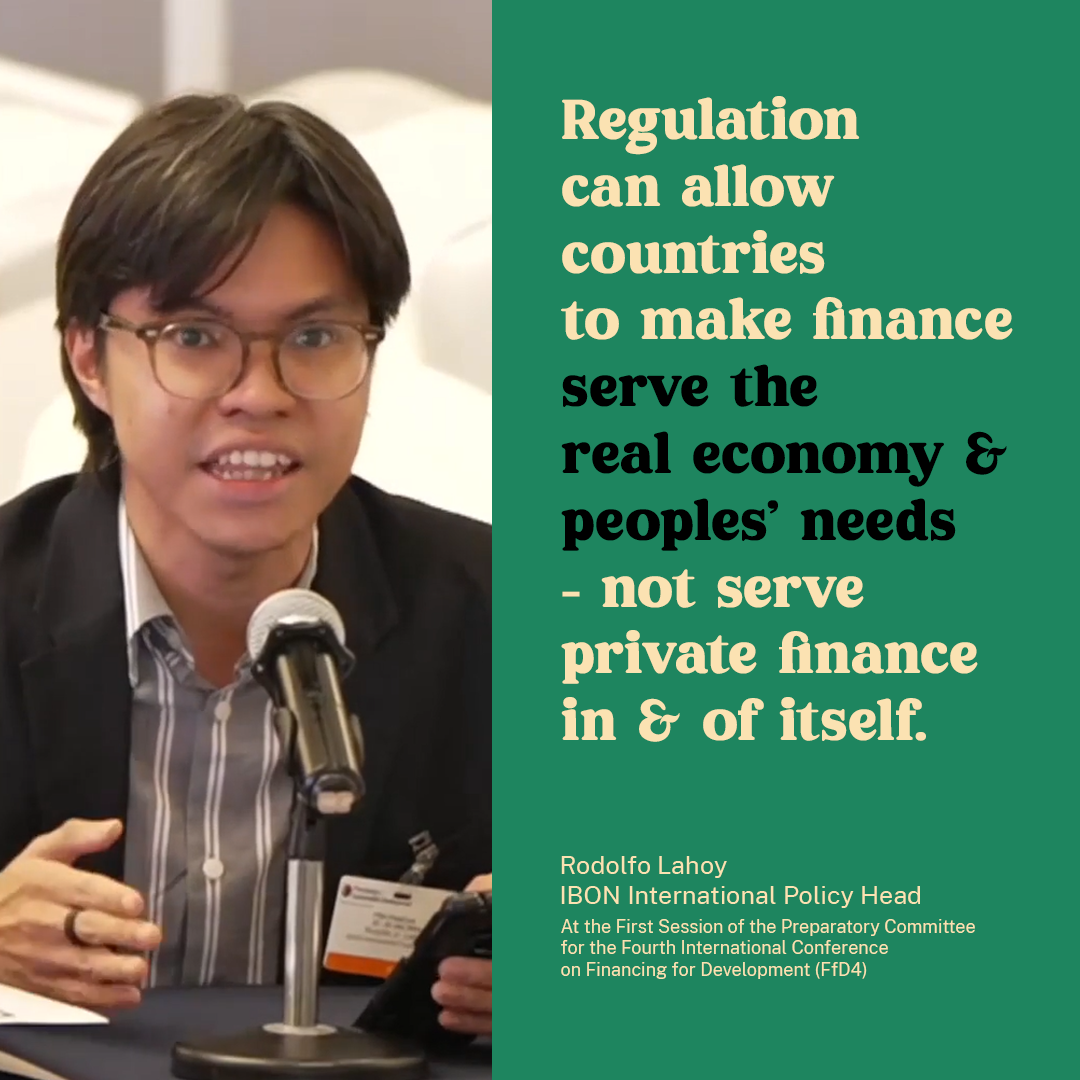

The following input was delivered by Rodolfo Lahoy, IBON International Policy Head, as part of the Civil Society FfD Mechanism, at the first session of the Preparatory Committee for the Fourth International Conference on Financing for Development (FfD4) held on 22 to 26 July 2024. Lahoy delivered a floor intervention at the multi-stakeholder roundtable on Domestic and International Private Business and Finance. FfD4 will be held in Seville, Spain in mid-2025.

Financial regulation is a key area for the policy space of the global South. Currently, countries in the global South are in a subsumed position to Northern finance capital. Previous financial crises expose both the failure in macroeconomic and financial regulation, and the governance vacuum over financial actors. Yet, these same actors, such as those in the asset management industry (who are majority corporate shareholders and private creditors), have expanded, along the way tying markets in the global South with financial institutions and the volatilities of unregulated markets – all in all generating high systemic risks, and capital flight. Sustainable industrial policy is challenging in this global context. We need to learn the lessons. We call on the United Nations (UN) to assess the current financial “non-system” and undertake decisive steps towards financial regulation, including a global regulatory framework for the asset management industry and a global agreement on the importance of capital account management.

We invite member-states to fully fulfil their developmental roles. Regulation, to curtail external risks, can allow countries to make finance serve the real economy and peoples’ needs at the domestic level – not private finance as a need in and of itself. Under austerity, reliance on institutional investors comes with spending less on public services. We live in a financialised world where growing shareholder profits of defense and mining companies, and growing food futures speculation, exist alongside obscene hunger, inequalities, and ecological destruction. The policy space for regulation also requires halting Investor-State Dispute Settlement (ISDS) mechanisms — we have a total of 1,332 ISDS cases at the moment. Of the 60 new ISDS initiated in 2023, about 70 per cent of new cases were brought against developing countries, including three least-developed countries (LDCs), mostly by investors from developed countries.

FfD4, as a process to democratise global economic governance and the international financial architecture, offers possibilities for new rules to bring global finance under democratic governance. We invite the UN to take the reins of redesigning the international financial architecture for peoples’ rights, especially the right to development and self-determination. #